The Indian government periodically revises the income tax structure to provide relief to taxpayers and enhance compliance. With the introduction of the New Tax Regime 2025, the latest tax slabs and rebates have been a topic of discussion, especially the ₹12 lakh rebate. This guide simplifies the new tax structure, helping you understand how much tax you will owe based on your income.

New Tax Regime 2025: What Has Changed?

The New Tax Regime 2025 is designed to offer lower tax rates while eliminating several deductions and exemptions that were available under the old regime. Some of the key changes include:

- Increased tax rebate threshold to ₹12 lakh under Section 87A.

- Simplified tax slabs to encourage more taxpayers to opt for the new regime.

- No requirement to claim multiple deductions, making tax filing easier.

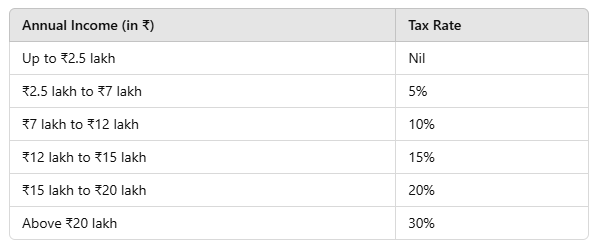

Income Tax Slabs Under the New Tax Regime 2025

The latest income tax slabs for individuals below 60 years under the new tax regime are:

Note: The rebate of up to ₹12 lakh means that individuals earning ₹12 lakh or below will not have to pay any tax after applying the rebate.

Understanding the ₹12 Lakh Rebate

Under Section 87A, taxpayers with net taxable income up to ₹12 lakh are eligible for a rebate, ensuring they pay zero tax. Here’s how it works:

- If your total taxable income is ₹12 lakh or below, you get a rebate equal to your total tax liability, effectively reducing it to zero.

- If your income exceeds ₹12 lakh, only the portion beyond ₹12 lakh is taxed as per the applicable slab rates.

Tax Calculation Examples

Example 1: Income Below ₹12 Lakh

Annual Income: ₹12 lakhTax

Calculation:

- Tax on ₹7-12 lakh: (₹5 lakh at 10%) = ₹50,000

- Rebate under Section 87A: ₹50,000 (Full tax amount rebated)

- Final Tax Payable: Zero

Example 2: Income Above ₹12 Lakh

Annual Income: ₹15 lakhTax Calculation:

- Tax on ₹7-12 lakh: (₹5 lakh at 10%) = ₹50,000

- Tax on ₹12-15 lakh: (₹3 lakh at 15%) = ₹45,000

- Total Tax Before Rebate: ₹95,000

- Rebate Under Section 87A: Not Applicable (Income above ₹12 lakh)

- Final Tax Payable: ₹95,000 + 4% Cess = ₹98,800

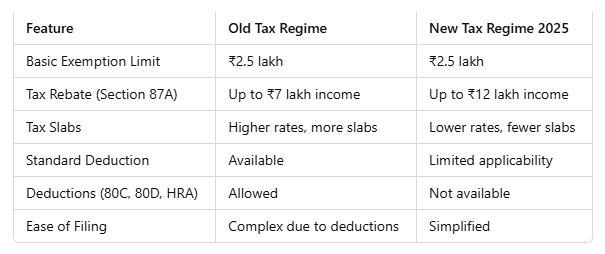

Comparison: Old vs. New Tax Regime 2025

Should You Choose the New Tax Regime 2025?

Who Benefits from the New Tax Regime?

- Salaried individuals without major deductions like home loans, investments, or HRA.

- Freelancers and business owners who do not want to maintain complex financial records.

- Individuals earning up to ₹12 lakh, as they can enjoy the full rebate.

Who Should Stick to the Old Regime?

- Individuals who claim high deductions under Sections 80C, 80D, and HRA.

- Those with home loans, as interest deduction on home loan (Section 24) is not available in the new regime.

How to Choose the Right Tax Regime?

Before filing your income tax return, compare both regimes:

- Calculate taxable income under both regimes.

- Consider your deductions and exemptions under the old regime.

- Choose the one where you pay the least tax.

- If earning below ₹12 lakh, the new regime is advantageous due to the rebate.

Frequently Asked Questions (FAQs)

1. Can I switch between the old and new tax regimes every year?

Yes, salaried individuals can switch each year, but businesses opting for the new regime must continue with it.

Is the standard deduction of ₹50,000 available in the new regime?

Yes, the government has retained the standard deduction for salaried employees in the new tax regime.

Do senior citizens get any additional benefit?

Senior citizens (60-80 years) and super senior citizens (80+ years) have different exemption limits under the old regime, but the new regime treats all age groups the same.

What happens if my income is slightly above ₹12 lakh?

Even one rupee above ₹12 lakh means you won’t get the full rebate, and you’ll be taxed as per the slabs.

Final Thoughts

The New Tax Regime 2025 simplifies tax filing and benefits those earning up to ₹12 lakh the most. However, if you have significant deductions, the old regime might still be a better option. Always analyze your financial situation before deciding which tax structure suits you best.

By understanding these changes, you can make an informed decision and optimize your tax savings for 2025!