Introduction

Overview of Axis Bank’s presence in the credit card market.

Brief explanation of why Axis Bank credit cards are popular in 2025.

Promise to cover the best Axis Bank credit cards, their features, benefits, and user reviews.

Overview of Axis Bank Credit Card Categories

Explanation of the different categories Axis Bank offers:

Travel Credit Cards

Lifestyle Credit Cards

Shopping & Cashback Credit Cards

Reward & Loyalty Credit Cards

Business & Corporate Credit Cards

Highlight the range of choices based on user needs and spending habits.

Top Axis Bank Credit Cards in 2025

Detailed review of each popular Axis Bank credit card. Each review can cover:

Axis Bank Select Credit Card

Axis Bank Magnus Credit Card

Axis Bank ACE Credit Card

Axis Bank Privilege Credit Card

Axis Bank Vistara Infinite Credit Card

Axis Bank Buzz Credit Card

Axis Bank My Zone Credit Card

Axis Bank Freecharge Credit Card

Axis Bank Neo Credit Card

Axis Bank Insta Easy Credit Card

For each card, provide:

Key Features: Including credit limit, rewards, and fees.

Benefits: Rewards, cashback, travel benefits, insurance, etc.

Eligibility Criteria: Age, income requirements.

Annual Fees & Charges: Fee structure and waiver conditions.

Comparing Axis Bank Credit Cards

Comparison chart or table listing features, fees, and benefits.

Summary of which cards are best for different user types:

Best for Travel

Best for Cashback

Best for Rewards

Benefits of Choosing Axis Bank Credit Cards

Reward Programs: Overview of Axis Bank’s reward points and redemption options.

EMI Conversion: Flexibility of converting transactions into EMI.

Exclusive Partnerships: Discounts and offers with brands like Amazon, Flipkart, etc.

Security Features: Fraud protection, zero liability policies, and real-time alerts.

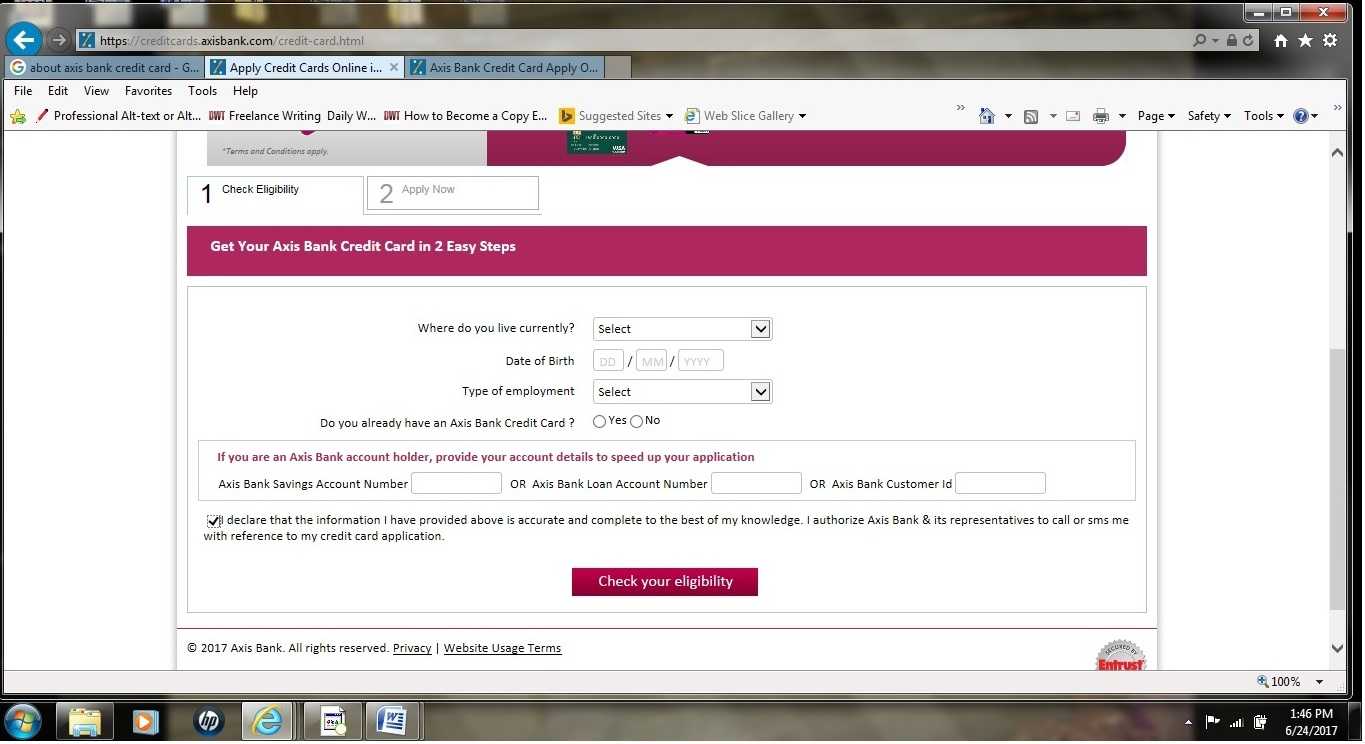

Application Process for Axis Bank Credit Cards

Step-by-step guide on how to apply.

Documents required for application.

Online and offline application methods.

Expected timeline for card approval and delivery.

Common Queries About Axis Bank Credit Cards

Answers to frequently asked questions.

Examples: “What is the process for raising a credit limit?”, “How to redeem reward points?”, etc.

Customer Reviews & Ratings

Collate customer feedback on key Axis Bank credit cards.

Pros and cons based on user experiences.

Insights into customer service and issue resolution.

Conclusion

Recap of the benefits of Axis Bank credit cards.

Encouragement to choose a card that aligns with personal spending and lifestyle.

Link to Axis Bank’s website or application portal for readers ready to apply.

Sample Introduction

Axis Bank, one of India’s leading financial institutions, offers a wide variety of credit cards tailored to meet the diverse needs of its customers. From travel enthusiasts to avid online shoppers, Axis Bank has a credit card for everyone. With new advancements in reward programs, attractive cashback offers, and exclusive perks, Axis Bank credit cards have quickly gained popularity in 2025.

This guide will walk you through the top Axis Bank credit cards for 2025, highlighting their features, benefits, and real customer reviews to help you make an informed choice. Whether you’re seeking a card with premium travel privileges, high cashback rates, or rewards on daily spends, there’s an Axis Bank credit card for you. Read on to discover the perfect Axis Bank credit card that matches your lifestyle and financial goals.

FAQs

What are the eligibility criteria for applying for an Axis Bank credit card?

Generally, you need to be between 18 and 70 years old and have a steady source of income. The specific income requirements vary depending on the credit card. Some cards are exclusively for salaried individuals, while others may have separate criteria for self-employed applicants.

How can I apply for an Axis Bank credit card?

You can apply online through the Axis Bank website by filling out the application form and uploading the required documents. Alternatively, you can visit an Axis Bank branch and apply in person.

How long does it take to receive my Axis Bank credit card after approval?

Once your application is approved, it usually takes 7-10 working days for the card to be delivered to your registered address. Axis Bank may also notify you of the card’s dispatch status via email or SMS.

What documents are required for the Axis Bank credit card application?

Basic documents include proof of identity (like an Aadhaar card or passport), proof of address, and proof of income (such as salary slips, ITR, or bank statements). Additional documents may be requested based on the type of card and applicant’s profile.

Are there annual fees for Axis Bank credit cards?

Yes, most Axis Bank credit cards come with an annual fee. However, some cards offer a waiver of the annual fee if you meet a specific spending threshold within the year. Check the terms of each card for details on fees and waivers.

How do I earn and redeem reward points on my Axis Bank credit card?

You earn reward points on eligible transactions based on your card type and spending category. Redemption options include cashback, travel vouchers, merchandise, and discounts with Axis Bank’s partner brands. You can redeem points through Axis Bank’s rewards portal or mobile app.

What should I do if I lose my Axis Bank credit card?

Immediately report the loss to Axis Bank’s customer service. They will block the card to prevent unauthorized transactions and guide you through the process of getting a replacement.

Can I convert my Axis Bank credit card purchases into EMIs?

Yes, Axis Bank allows you to convert eligible transactions into EMIs, making it easier to manage large expenses. You can convert transactions above a certain amount, typically within a specific time frame after the purchase, via internet banking or customer service.

How can I increase my credit limit on an Axis Bank credit card?

Axis Bank periodically reviews your credit history and spending patterns for a potential limit increase. You can also request a credit limit enhancement by contacting customer service, though approval depends on your credit profile and income.

What are the foreign transaction fees on Axis Bank credit cards?

Foreign transactions usually incur a fee of around 3.5% of the transaction amount. This may vary depending on the specific card, so it’s best to check your card’s terms if you frequently make international purchases.

Do Axis Bank credit cards come with insurance benefits?

Many Axis Bank credit cards offer complimentary insurance benefits, such as travel insurance, lost card liability coverage, and purchase protection. These benefits depend on the card tier and type, so check individual card details for specifics.

Can I get a supplementary credit card for my family members?

Yes, Axis Bank allows you to apply for supplementary (add-on) cards for family members above 18 years. These cards share the primary card’s credit limit, and you’ll receive a combined statement for easy tracking.

How can I check my Axis Bank credit card statement?

Statements are accessible through internet banking, the Axis Bank mobile app, or via email. You can also request a physical statement by contacting customer service, although this may incur additional fees.

Is there a reward redemption fee on Axis Bank credit cards?

Some Axis Bank cards may charge a nominal fee for reward redemptions. It’s best to check your specific card’s terms and conditions to know if a fee applies.

How do I contact Axis Bank customer support for credit card issues?

Axis Bank provides 24/7 customer support via its helpline number, and you can also reach them through internet banking, the Axis Bank mobile app, or by visiting the nearest branch.